Payday Loans

There is no exact definition of payday. It is known as a day of the week or month on which day people get their wages or salary. Meanwhile, due to financial emergencies, people borrow money from lenders or banks on behalf they will repay on the upcoming or next payday.

What is a payday loan?

Payday loans are small sums of money for a short-term duration (1 week to 4 weeks). Offered from direct lenders or banks at high rates of interest for borrowers. The loan amount may be up to $1500 with no credit checks loans. It depends on your repayment affordability and credit history.

Generally, the borrower has to repay all payday loan amounts in one payment on the next payday. If you miss the payback on time, it may cause an issue for you or borrowers. And you may have to pay late fees and very high interest to the lenders and banks.

When you apply to borrow a payday loan?

Typically, borrowers may apply for an emergency financial need before the next payday. So it is best time to apply fast payday loan online to get money from direct lenders Immediately.

To come out from your current financial crisis without stress. The loan amount may be in cash, check, or direct transferred to your bank account.

Mostly, the lenders will give instant loan approval without checking your credit score on the basis of your repayment income source.

On the other hand, Some lenders or banks provide easy payday installment loans with flexible repayment terms but short terms.

How do lenders work on payday loans for their customers?

Online payday loan direct lenders always work a little differently from a personal loan or other consumer loan. They do a soft verification of your payback income source and borrower account information.

They will approve the your payday loan application online. You will receive the loan amount in your account, as you deserve. The total loan amount will have to be repaid in 30 days, or it may be for one week or fortnight.

It depends on your residential area so that you can get approval on payday loans online. However, you will get a cash payday loan amount through the physical branch.

In the different states, There are many lenders, and they have different policies for the delivery of emergency loans for payday. Typically, loans till payday have a limit on how much you can borrow or how much they can charge interest and fees.

How much can you borrow up to?

A borrower can borrow a sum of amounts up to $5,000 from a lenders. It depends on your credit history, repayment capability, and your weekly monthly income. Because it is very risky for lenders, and becomes very costly interest rates for borrowers compared to other personal loans.

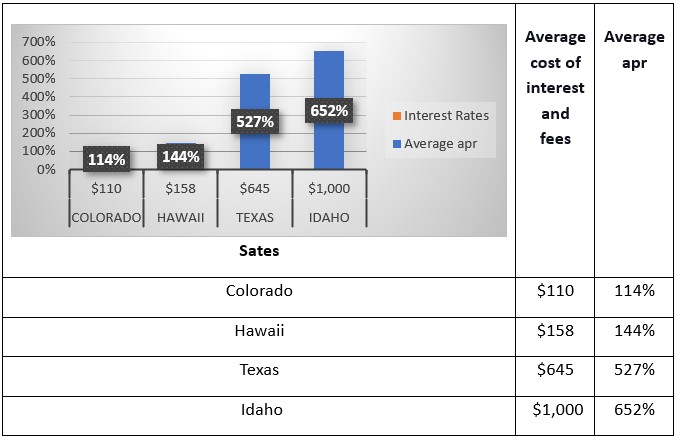

Interest rates on payday borrowers

What rates of interest do the lenders charge on payday money? It depends on the lenders to lenders and state to state. There are some variable chart below:

Reason for choosing payday loan from a direct lender versus a Bank

Typically, There may be several beneficial reasons to borrow payday money from a direct lender compared to banks, such as:

- Get a quick and fast loan approval process.

- Instant money access

- No hard credit history check policy is required.

- You may get cash in hand in your area at your door.

- There are no hidden fees or upfront fees.

- Flexible repayment terms and long-term duration

- Maybe get a big loan amount at repayment capability.

How is a payday loan costly from lenders?

According to the regulation of the Consumer Financial Protection Bureau (CFPB), payday lenders charge $10 to $30 on each borrowing $100. Normally, you will have to repay the end of the loan terms of $115 to the lender.

However, when you cannot repay the total loan amount on time at once, It becomes more costly for you. It’s important to note that when you miss a payment, lenders often add late fees and interest to the principal loan amount, significantly increasing your debt for the next due date.

Is there any alternative to Payday Loans?

A financial emergency always creates unnecessary stress on people. Normally, they move without checking loans like payday loans, but they always become high repaying loans.

In this situation, they look for some alternatives to payday loans at low-interest rates without credit checks. There are some alternative loans to payday.

Personal loan: This is a type of unsecured personal loan that lenders offer at low-interest rates. They do not require you to check your credit history.

Payday Installment Loans – It allow you to borrow lump sum money from lenders over repayment monthly at fixed regular terms. Like personal loan, auto loan and student loans are the best example of installment loans.

FAQs

Can I get payday loans in 1 hour online?

No, It is not possible to get a loan in 1 hour near me. If anyone, they promise to give you the loan amount in your account within 1 hour. Definitely they are trying to do a scan with you. Every lenders go through their some standart terms and condition before giving loan approval. After that they may be transfer in 1 hour payday loan amount in your accounts.

Do you provide loans without credit checks?

It’s a myth. Lenders do not check your credit scores. It’s significant to know about checking your credit history. Often Most lenders use a soft credit history reviewing instead of hard credit checking for payday loan scenario. They do not go through complete assessment of your creditworthiness like us. We do not check the borrower’s credit history. We check for any major red flag satisfying before got loan approved on the basis of your regular income and repayment affordability. Because payday loan always issued on high interest rates with a regulated fee.

Do I need a guarantor to get payday loan approval?

A guarantor or collateral always increases your loan approval probability in any financial situation. The interesting thing is that you do not need to keep any asset as security or provide a guarantor. We approve 99% of payday loans with no guarantor or collateral. After approval, the loan amount will be transferred to your bank account on the same day.

Do you consider bad credit payday loan approval?

Bad credit is not a good sound for borrower history. It is always a big reason for loan approval denial if you apply for a loan from direct lenders. But not to worry. We always consider bad credit payday loans and got 99% of loan applications approved.